In the US, DTC ecommerce sales for established brands will reach $117.47 billion this year, more than three times larger than those of digitally native brands. DTC sales are expected to reach $161.22 billion by 2024. Show

What’s behind this growth? At the height of the pandemic, 10 years of ecommerce growth happened in just 90 days. Eighty-four percent of consumers shopped online since the start of the pandemic. For almost 150 million of them, it was the first time they’d ever shopped virtually. Expectations around online shopping have shifted—people are now open to the concept. Far from being a novel idea, shoppers are now purchasing from and seeking out DTC brands. In 2021, 60% of Americans purchased from a DTC brand at least once. As brands shift to DTC models, they’re cutting out the wholesale- and retail-store middlemen, and instead selling directly to the end customer. Here’s how you can do the same. Get the latest ecommerce trends, insights and resources straight to your inboxBy submitting this form, you agree to receive promotional messages from Shopify. Unsubscribe any time by clicking the link in our emails. Table of contents

Direct-to- consumer (DTC) is when a brand or manufacturer sells its own products to its end customers. The DTC retail model involves selling products without the help of third-party retailers or wholesalers. The DTC retail model is defined by:

The DTC retail model is growing in popularity because it brings brands closer to customers. DTC brands directly interact with customers, strengthening relationships. By going DTC, brands also get a better understanding of who’s buying their products and why. DTC eliminates several steps of the buying cycle and often provides a more efficient customer experience. In fact, 66% of online shoppers have purchased directly from brands in the past three months. According to eMarketer’s forecast, US DTC ecommerce sales will reach $151.2 billion in 2022, an increase of 16.9% compared to 2021. Direct-to-consumer vs. wholesaleAt its core, DTC means selling your own products to the customer yourself instead of selling through a platform like Amazon or a retailer like Nordstrom. A wholesale model is when producers sell their products in volume to a retailer. The retailer then acts as a middleman by marketing and selling these products to consumers. Using the DTC model, the goal is to lower costs and enhance profits by removing retailers’ sales commissions and display space costs. DTC marketing usually involves more targeted messaging, aiming to reach people who are most likely to be interested in buying the product. To reach a more targeted customer base, DTC often involves monitoring customer preferences over time. Here’s how wholesale and DTC retail models differ:

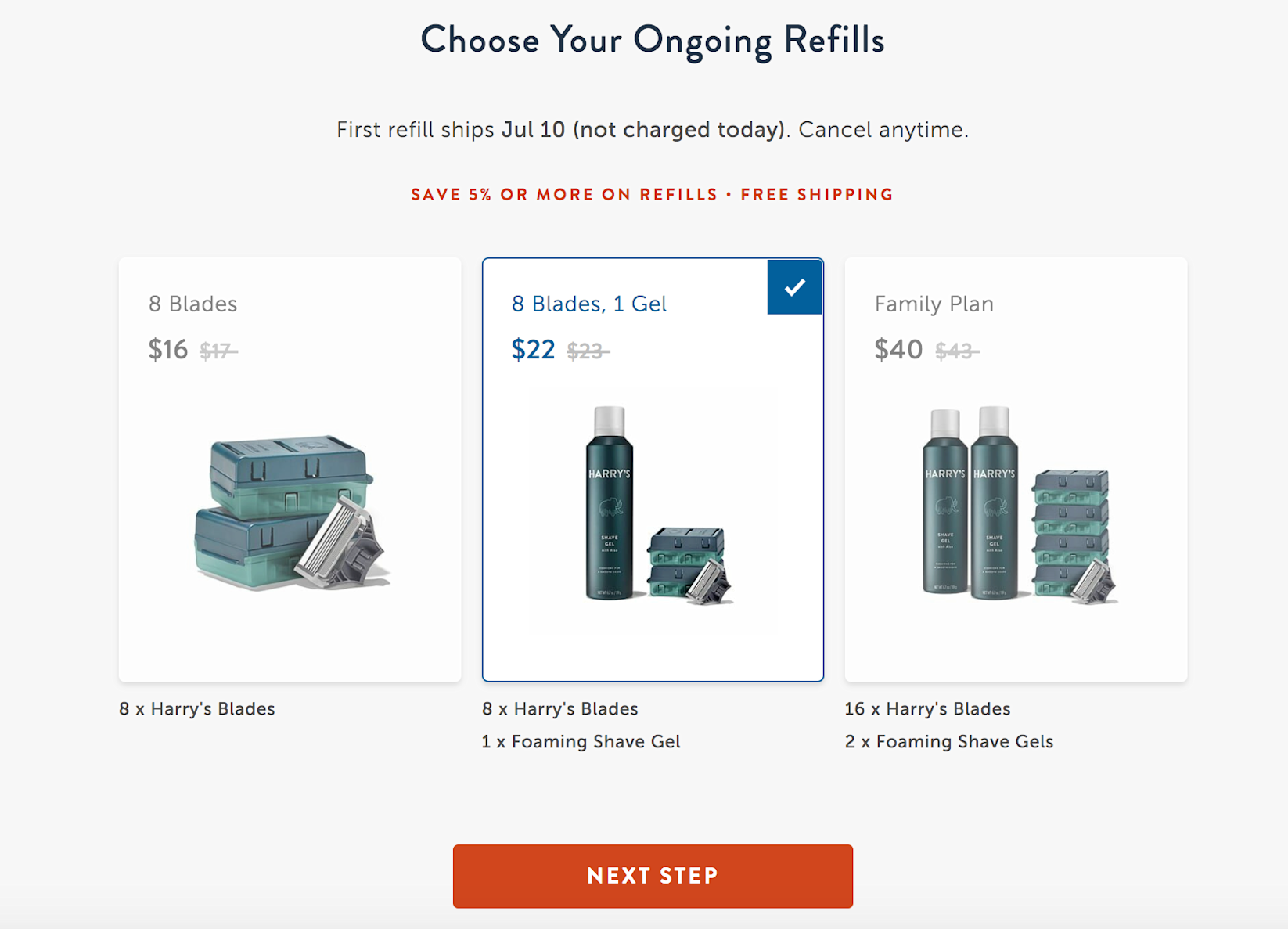

While wholesale doesn’t have as strong growth as DTC, the US wholesale industry was still worth an estimated US $6051.5 billion in 2021. Direct-to-consumer and retailChoosing between wholesale and DTC retail strategies isn’t always clear cut. Some brands, like Nike, have a combination of both. In 2010, DTC made up just 15% of Nike’s total revenue. By 2020, the athletics retailer had grown that number to 35%. Nike raked in $44.5 billion in 2021 on the back of a 40% DTC business, with plans to make $50 billion in 2022. Nike is a clear success story of how partnering with retailers and selling DTC can coexist. But it’s not always that easy. Often in your attempt to strengthen the customer relationship, you’ll sidestep trusted retail partners. It can seem like DTC brands are in a sales competition with their retail partners. Selling direct-to-consumer for the first time is a delicate balancing act of maximizing your brand’s DTC reach while trying not to sever ties with established retailers. In fact when done right, going DTC can cement the partnership between brands and big-box retailers. It’s usually a case of following a few best practices and seeing your retailer as a true partner. Since there’s 82% brand awareness for traditional brands among online shoppers, brands often find they need a healthy mixture of retail and DTC sales to maximize their revenue. Using brick-and-mortar to establish a brand presenceRetail brick-and-mortar stores are one way for DTC brands to establish a presence. Soda brand Olipop is a pandemic DTC convert success story. Despite never having sold online, Olipop saw a tenfold increase in sales over 2020–2021. But behind this overnight success story is a careful retail strategy that got the brand in front of target customers. Many of its customers already knew about its products from purchasing them in retail stores like Kroger and Sprouts. This presence in well known brick-and-mortar stores undoubtedly set the brand up for success as it ventured into the DTC space. Right now, the brand sees a 50% split between retail and ecommerce sales. As Olipop has increased its DTC sales, it definitely hasn’t burned bridges with retailers. Instead, it’s strengthened its ties. Its soda drink range is now available in US superstore giant Walmart. Sell different itemsBy selling directly to consumers you might run the risk of undercutting your retail partners. Understandably this might upset retailers. To avoid competing with retail partners, think of how to sell items in different ways. For example, Olipop sells sample-size packs through its online page and full-size packs via retailers. Male-grooming DTC brand Harry’s sells razors through Walmart. On its site, Harry’s sells subscriptions to its razors. Benefits of direct-to-consumerRetail expert Andrew Lipsman says that DTC sales will account for one in seven ecommerce dollars this year. He expects it will add almost another $100 billion in the next three years, reaching $212.9 billion by the end of 2024. Nearly 60% of online shoppers say they will go out of their way to purchase directly from a brand instead of a third-party retailer when possible. What’s driving this shift toward DTC brands? A combination of benefits for both customers and brands. Compete with established retail brandsWhere some traditional retail brands might blend in, DTC brands have a unique opportunity to stand out from the crowd. Free from retailers’ interpretations of their products, DTC brands can get creative and showcase their individual values. Sixty-six percent of shoppers say it’s easier to understand the values of individual brands. Since 70% of consumers prefer to shop with brands that reflect their own principles, DTCs have a big advantage here. Each D2C is challenged with convincing customers that it offers something consumers can’t find anywhere else. For Ricky Joshi, co-founder and chief strategy officer at mattress company Saatva, standing out from the crowd means avoiding the “glitz and glitter” that surrounds typical DTC brands and instead “sticking to the value proposition and the philosophy of the company as it started.” DTC brands can also offer customers a full assortment line of products without being limited to what retailers believe are trending items. Giving shoppers more choice can be a key way of driving them to your DTC site. Control over distribution channelsTraditional retailers need to ship products to a wholesaler, who goes on to deliver them to the end consumer. The longer your supply chain, the more exposed you are to problems. One bump in the road causes delays for everyone next in line. DTC retailers leave less risk exposed in their supply chain. That’s more important than ever, with COVID-19 wreaking havoc on global supply chains. Take the Molson Coors Beverage Company, for example. The pandemic disrupted the company’s traditional distribution channels. It went DTC via its online store and grew sales by 188% month over month.

—Paul Wyber, founder of Gerry’s Retail stores are in complete control over where they place your products, too. What might sound like a small difference can have huge impacts on revenue. In one study, the same product saw a 25% dip in sales when continually placed on one shelf over another. The same item placed on shelves at eye-level sold better. Experiment and get customer feedbackSelling directly to the consumer means you have eyes all over the customer journey, from start to finish. You’ll understand why they’re purchasing (and how)—insight that would’ve gotten lost if those products were sold through traditional retail strategies. Take Molson Coors, for example. After pivoting its business to sell DTC online, it made some optimizations based on data it had collected. That included:

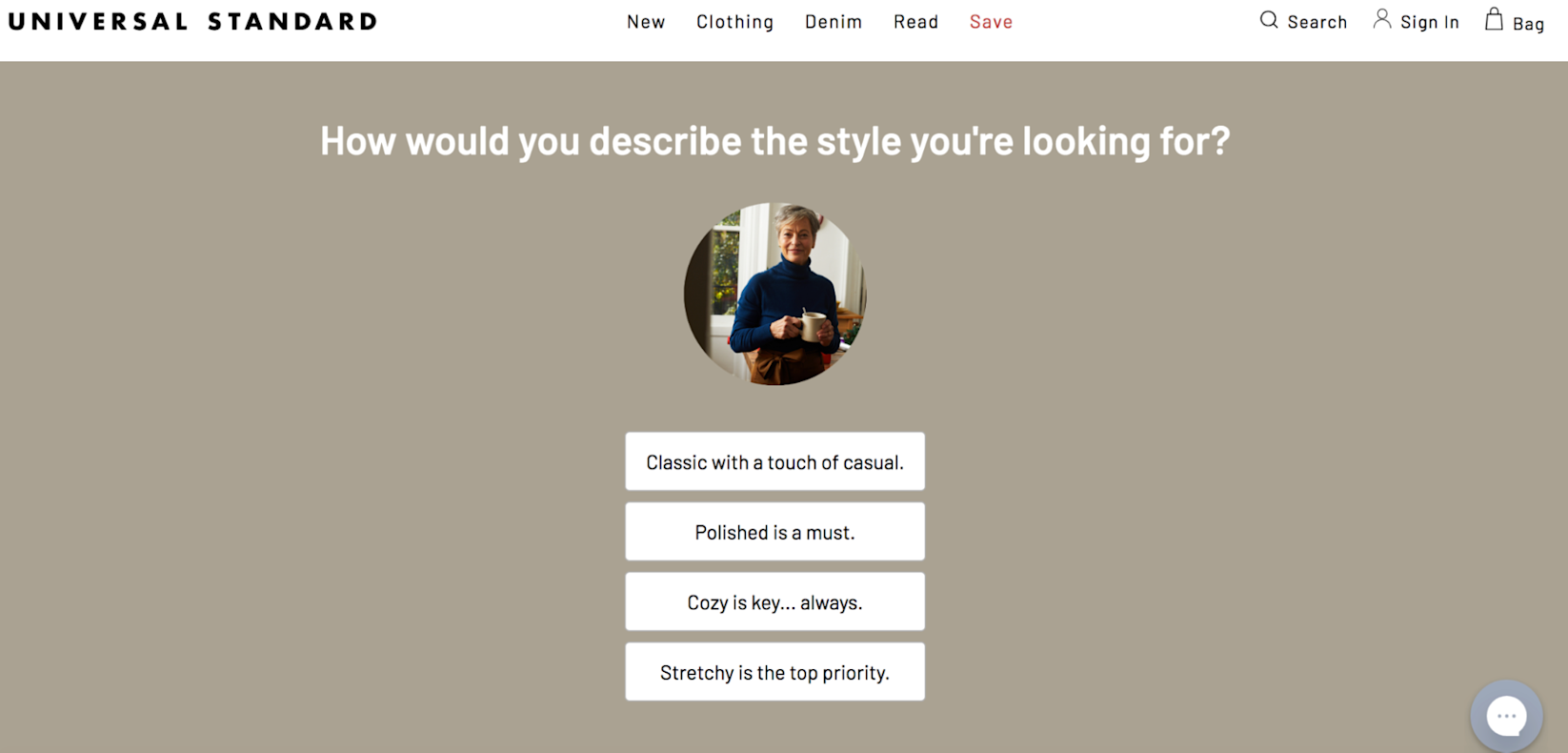

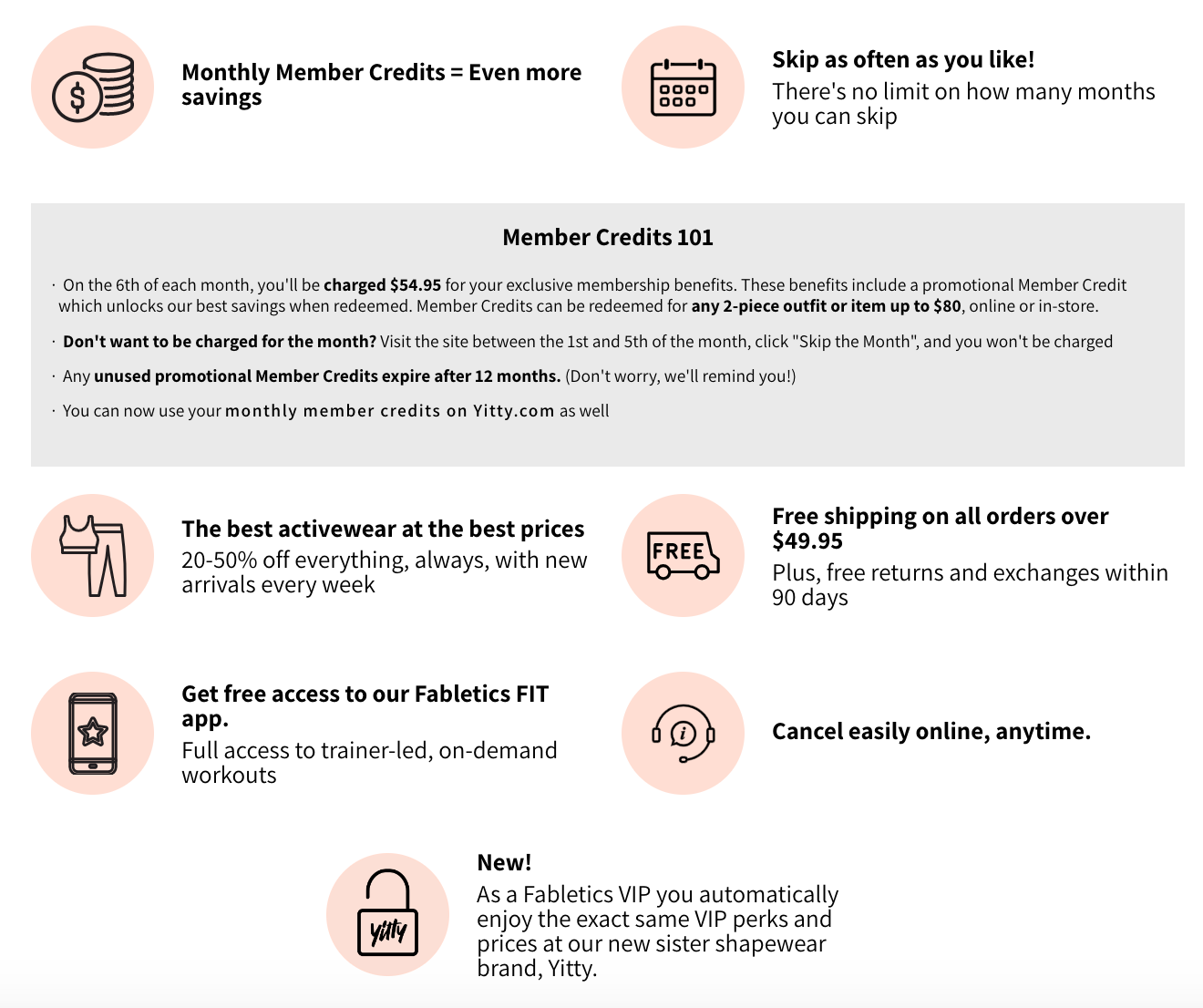

Having this oversight into a consumer’s experience with your product means you’ll develop and iterate faster. You’ll know the stumbling blocks and demands from customers without having to battle each retailer for access to customer data. “I’ve always been a big believer that owning the relationship with your customers is the most powerful thing you can do, and by being DTC only, this allows us to control the customer experience from start to finish. In order for us to provide the best experience for our customers, we need to understand them as best we can, and by using traditional retailers and marketplaces, we lose those vital insights.”—Paul Wyber, founder of Gerry’s More funding and investment opportunitiesUBS predicts 50,000 retail store closures in the US by 2026. This so-called retail apocalypse is triggering investments in DTC brands. That investment doesn’t just come from the brands themselves. Venture capital firms are plowing cash into DTC brands more quickly than ever. Globally, D2C startups have raised between $8 billion to $10 billion in known venture capital across more than 600 deals since the start of 2019, according to Crunchbase data. Amongst the most notable was Glossier, which received an $80 million investment in 2021, bringing its total funding amount north of $260 million. The sudden growth of DTC companies has worried big-box retailers, causing them to claim major stakes in digitally native brands. Target bought a stake in DTC mattress retailer Casper for $80 million. Walmart acquired Bonobos for $310 million in 2017. Unilever also acquired legendary DTC brand Dollar Shave Club for $1 billion the year before. Investors see the value in cutting the middleman out of traditional retail channels. They don’t have to compete on price when dealing with wholesalers and big-box stores. The higher profit margins up for grabs when selling directly to consumers are appealing. Ability to personalize customer experienceSixty-one percent of online shoppers say individual brands provide a more personalized experience. Without the limitations of big-box retailers, DTC brands can shine at providing customers with personalized experiences. In 2022, 42% of brands plan to offer their customers personalized product recommendations through tools like quizzes, custom mobile apps, and first-party or third-party behavioral data. For example, the size-inclusive clothing brand Universal Standard has a gift finder quiz that asks customers questions about their preferred clothing style and color palette. DTC brands can also personalize the customer experience with subscription programs. These have the added benefit of giving DTCs recurring revenue and boosting customer loyalty. For example, the athletic apparel company Fabletics has a VIP membership program that offers members special perks. Each month, the brand provides subscribers with a curated collection, offers exclusive discounts, and gives them free shipping. This level of personalization removes the stress from shopping and makes it more enjoyable. Boost margins without increasing the priceDirect-to-consumer companies don’t have to make cuts to their profit margins. There’s no retailer, wholesaler, or marketplace claiming their fair share of a product’s retail price. DTC brands can also reduce their CAPEX or commercial rent costs. They don’t always need to rent costly physical retail spaces to increase growth. Because of this extra profitability baked into each item, DTC brands choose to sell their products at a lower cost through their owned channels. Lower prices were the leading reason for choosing a D2C brand over a traditional retailer. Almost half said they’re going direct to get products at lower prices (48%). Fast and free shipping followed shortly behind. 10 examples of DTC brands to learn fromHere are 10 examples of DTC brands disrupting the market. 1. AwaySteph Korey and Jen Rubio, founders of Away, set out to breathe life into the luggage industry. Instead of calling themselves a luggage brand, they marketed themselves as a travel company. No one had really invested in this narrative before. Noticing how expensive high-quality suitcases were, the pair set out to alleviate the price and quality problem that fuels high-priced luggage. They realized that the main reasons suitcases are so expensive is down to distribution costs and the high markup retailers place on the items. Co-founder Steph Korey says that they noticed a huge gap in the market for high-quality luggage without the sky-high price tag. She says:

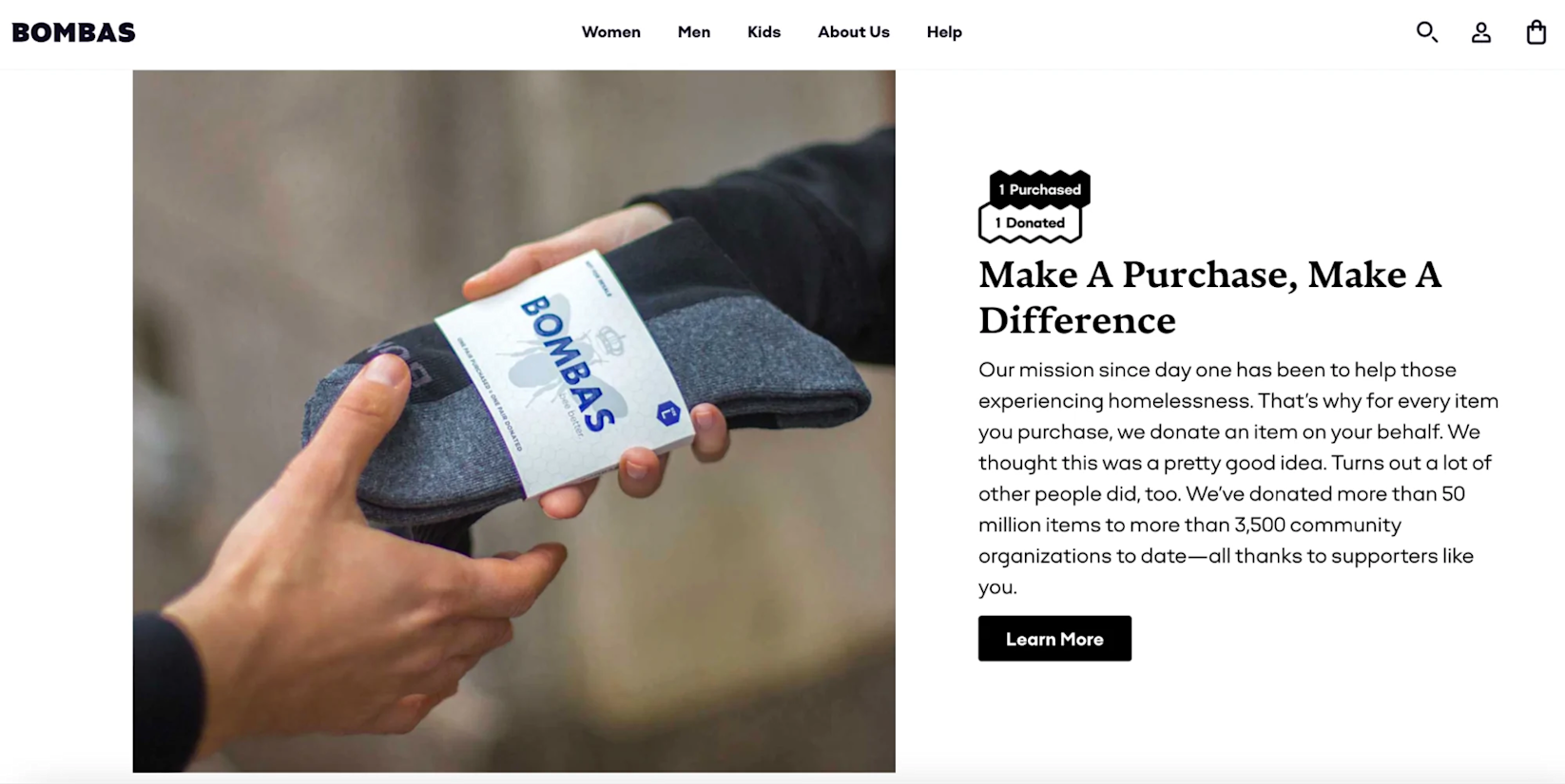

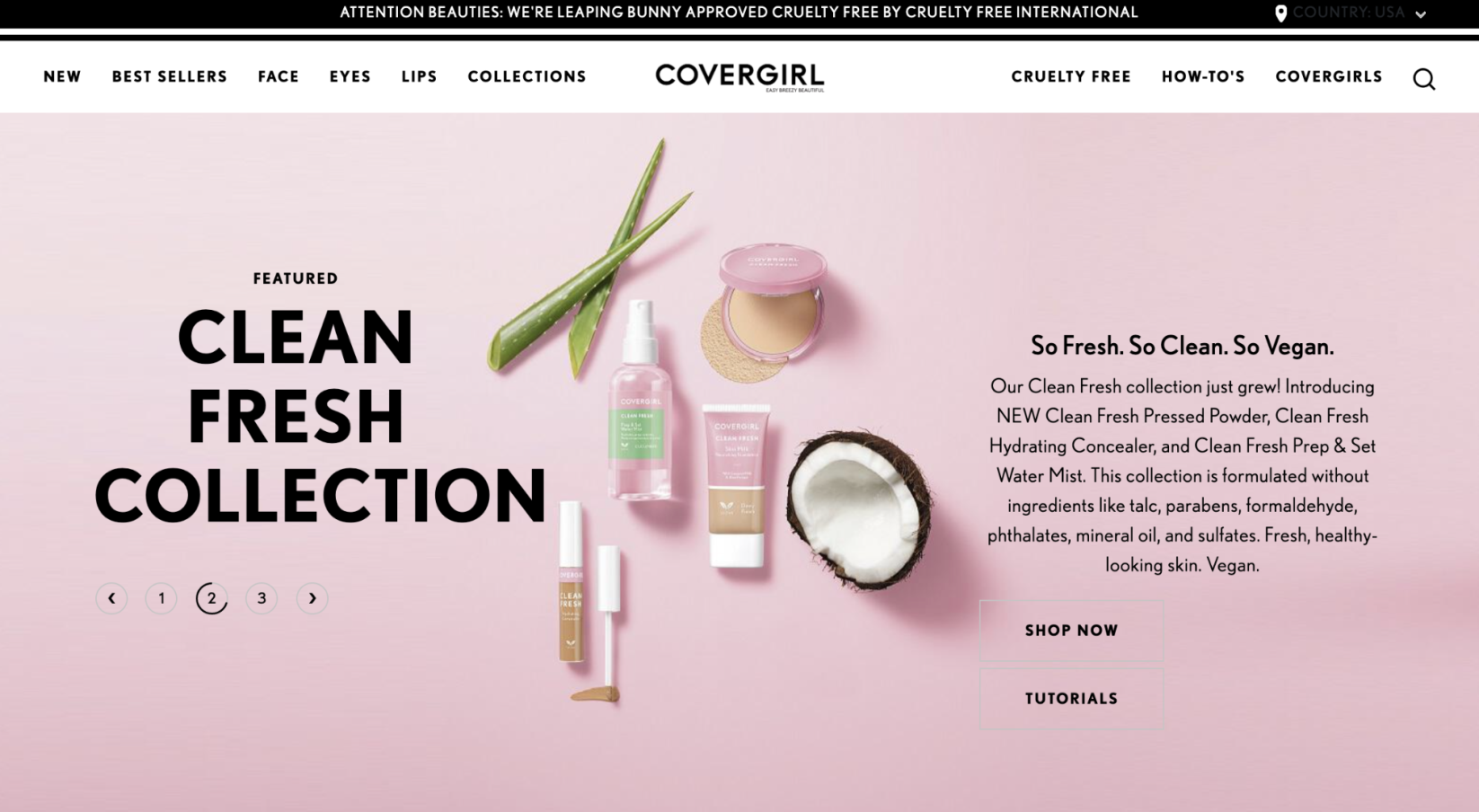

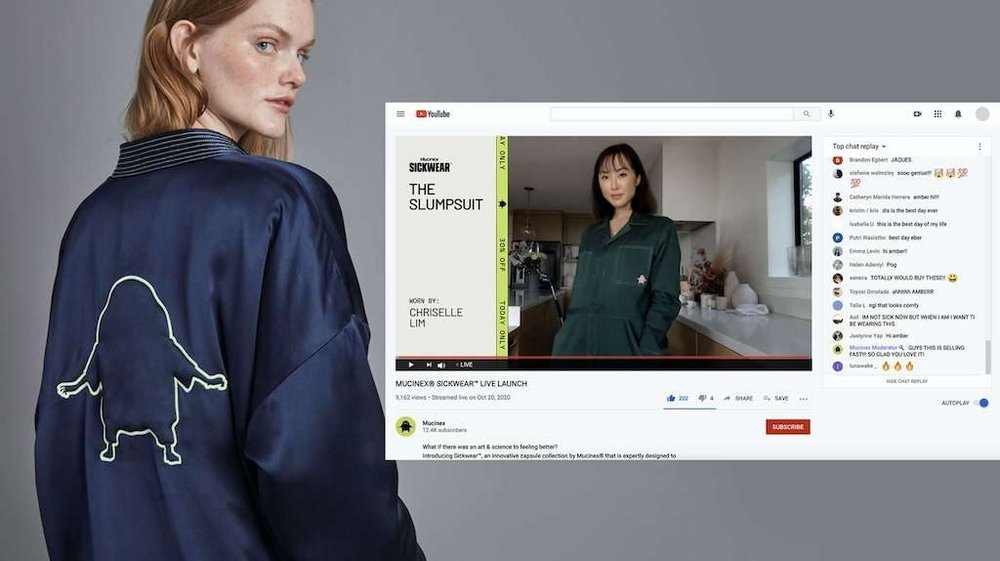

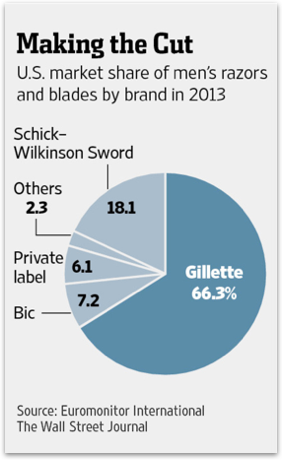

By eliminating the retail middleman, Korey and Rubio found a way to offer their suitcases at prices their target audience was prepared to pay. They didn’t have to sacrifice product quality to make a profit either. 2. AllbirdsDTC pioneer Allbirds grew a loyal digital fanbase using Shopify before trying out a pop-up shop. That first pop-up opened the way for a global retail presence consisting of 22 stores and counting. A value-driven DTC brand, they appeal to an environmentally conscious audience. Allbirds practices what it preaches when it comes to sustainability too. Travis Boyce, Allbirds vice president of marketing, explains that sustainability has always been at the core of the business, and that the brand takes all the steps it can to offset its impact. “So for us, it’s our products, it’s our headquarters, it’s our stores, it’s the commutes to work,” he says. “Everything is our impact from a carbon standpoint. And we want to measure that. So we measure that. We completely offset it 100% so that we are carbon neutral. And then it only matters if you offset it if you start to work to reduce it. So we are constantly looking at ways to reduce our impact from a carbon footprint standpoint across every aspect of our business.” Allbirds’ values clearly appeal to its target audience too—in 2021, its revenue hit $277 million, up 27% from 2020. 3. LoveverySubscription ecommerce sales are predicted to hit $32.65 billion in 2022. Customers often like the novelty of receiving curated product selections or like the convenience of receiving replenishment items. Providing customers with subscriptions can be an effective way for DTC brands to increase customer retention and bring in monthly recurring revenue. Shopify-based Lovevery is a DTC subscription brand for kids’ toys. Roderick Morris co-founded Lovevery to offer parents a subscription-based package of toys that evolve with children as they grow. Retailers often use subscription models for replenishment items like food and beverages or personal care items. But Lovery has a different approach. It aims to accompany children as they grow, providing what they need as they develop. Roderick Morris gives an excellent example of how this works. “The child is constantly evolving, and the parents’ needs are evolving, too—that’s different from a razor subscription, for example, where I’m getting the same razor every six weeks, and my fundamental need to shave my beard is not changing from month to month. With a baby, what they need is fundamentally different three months later than at a particular point in time than with a toddler.” This approach to accompanying parents’ and children’s changing needs help Lovery retain customers for many years. “Our customers often stay with us for three or more years. The most popular play kit is the one for newborns—more than 20% of our customers start there. After a year of subscribing, more than 70% of these customers are still active. After two years, more than 50% are still active.” 4. BombasShopify-based Bombas began its DTC journey by selling socks. Driven by social causes, the company’s founders insisted that for every pair of socks they sold, they would donate another pair to someone affected by homelessness. Thanks to its motto, “Comfort is everything,” Bombas has attracted a niche following and has since branched out to sell other products like underwear, t-shirts, and slippers. 5. CoverGirlHistorically, Shopify-based beauty and cosmetics brand CoverGirl had only sold at big-box distributors and online marketplaces. By leveraging existing celebrity endorsements, CoverGirl was able to experiment with DTC quickly. With the help of 1 Rockwell, the company launched its ecommerce website in just four weeks. CoverGirl is also an example of a DTC brand that has maintained retail partnerships while selling to consumers via its website. At the time of its shift to DTC, its chief marketing officer, Ukonwa Ojo, had this to say about the decision: “We actually see it as a great place for learning, to make the traditional retail work harder. Now, we can go to our retail partners with insights, and say, ‘These are the products that are doing particularly well,’ or ‘Here's some technologies that you can bring into your store to elevate the shopping experience’.” 6. ScentbirdScentbird is a fragrance subscription service that lets members try new fragrances with each shipment. They provide a wide selection of both designer and niche brands for subscribers to try. Starting at just $14.95 per month, it’s an affordable way for subscribers to try scents without going in-store for a sample or purchasing a full bottle. Tapping into consumer desire for personalization and high-quality customer service, Scentbird has a dedicated team of fragrance experts who help subscribers find the right scent for any occasion. Founder Mariya Nurislamova explains that Scentbird makes it easy for consumers to try out perfumes without making a larger commitment. “We help consumers ‘date’ fragrances before marrying them by shipping 30-day supplies of high-end perfume to people’s homes,” she says. 7. OlipopSocially conscious Shopify DTC Olipop is built on the back of helping consumers make more nutritionally conscious decisions. Pushing against the tradition that soda is unhealthy, founders Ben Goodwin and David Lester set about using science to develop a delicious product that gave people a healthy alternative to soda. David Lester explains they faced skepticism surrounding their product until their original idea took off. “The idea of doing a healthy soda was ridiculous to people until we actually made it work.” Like many other businesses, the pandemic sparked enormous DTC sales growth for Olipop,” he says. “During the pandemic, a lot of the growth was actually driven by our D2C business that went from under 10% of our overall revenue to now between 40% and 50%. Nationally, we are in around 6,000 retail stores and will probably double that by the end of the year. Because of that growth, we are seeing other brands come into what is now being termed as the functional soda space.” 8. The Honest CompanySome of the most successful DTCs are created to solve a common customer problem. Launched by Hollywood actor Jessica Alba, The Honest Company sells safe, eco-friendly, and affordable child care products. Alba had become frustrated at how difficult it was to find products that met her standards. The brand’s well-defined mission and strong social media community helped it attain unicorn status in 2015. 9. MucinexAs America’s number one doctor-recommended cough and cold brand, Mucinex wasn’t an obvious contender to launch a DTC clothing range. When the COVID-19 pandemic hit, Mucinex raised its brand purpose—“To be a helper”—by launching a DTC business model that let customers buy its products more easily in a time of need. To create hype for the DTC launch, Mucinex worked with fashion designers to create Mucinex Sickwear, a limited edition clothing line designed to help consumers feel better. Mucinex livestreamed a fashion show featuring influencers wearing the new Sickwear capsule collection on YouTube. As a result, sales of Mucinex products and Sickwear on the new DTC platform soared. The collection sold out in less than 24 hours and Mucinex product sales increased by over 235% in one day. The launch also generated more than 95 million earned media impressions. 10. Harry’sWhen razor-subscription brand Harry’s launched in 2013, it moved into a heavily dominated and crowded marketplace—Gillette owned 66.3% of the market share. But Harry’s understood and tapped into the power of referral marketing—83% of satisfied customers are willing to refer products and services. Co-founder and CEO Jeff Raider explains that credible referrals were the driving force behind the brand. “The idea for our campaign was built around our belief that the most powerful and effective way to be introduced to our new company was through a credible referral,” he says. “Thus, we focused on building a campaign that helped people to spread the word to their friends.” The brand’s determination to shake up the shaving industry and drive innovative marketing campaigns paid off—Harry’s currently has 20 million global customers and counting. How to get started with direct-to-consumer sellingBefore you get started with DTC selling, it’s important to consider whether it’s the right approach for your brand. Consider these five points before you commit to launching your DTC strategy. 1. Your reputation is everythingWhile selling directly to the consumer does have its benefits, retailers need to know that their reputation is everything. Traditional CPG companies have the luxury of marketplaces and big-box retailers dealing with the customer purchasing experience. Paul Wyber the founder of Gerry’s explains how DTC brands need to approach customer experience. "DTC brands need to ensure their customers have the best possible purchasing experience from start to finish. This includes things like ensuring the website all the way down to the goods the consumer receives in the mail are all without issues, as it is your brand reputation on the line throughout this whole process."

2. You can’t depend on a marketplace or retailer’s existing audienceIt’s no secret that Amazon is a growing ecommerce machine. By choosing to skip selling your products through its marketplace, you’re missing out on capturing the 63% of shoppers who head to Amazon at the start of their product search. While you could still sell some products via these retail or wholesale channels, you’ll need to invest heavily in your own channels to make up for it. Because of this, 41% of DTC brands plan to increase paid and organic search investment. Brands selling directly to the consumer need to splash the cash on digital channels in a bid for Amazon customers’ attention. 3. Severing ties with retailersChoosing between wholesale and direct-to-consumer strategies isn’t black and white. Some retailers, including Nike, have a combination of both. The downside to this is that sometimes, wholesale and retail customers are upset when one of their brands moves to DTC. Heinz is a fine example. Its 2020 Heinz to Home DTC move reportedly worried many wholesalers—with one saying the bundles were undercutting retailers with their discounted pricing. As a result, Heinz issued a statement explaining the decision, to ease its retail partners’ concerns: “We are offering free delivery and priority shipment for them. We also recognize that others who are vulnerable and self-isolated may struggle to get access to our brands. Since it is very difficult for us to identify this group, the online shop is open to everyone, but with the cost of packaging and delivery on top.” 4. Fulfillment costsInstead of bulk distribution, DTC needs one-off, last-mile delivery. You’ll need to choose between fulfilling online orders yourself or partnering with retailers to fulfill orders. The latter option is often best if you’re experimenting with DTC. DTC brands also need to consider:

A big concern for digital-only DTC companies is returns. In 2021, retail merchandise returned in the United States accounted for $761 billion, a big increase from $428 billion reported in the previous year. Return rates for online shops are usually higher than for their physical store peers. To better manage them, DTC companies may need to integrate a returns-management system with their ERP, third-party logistics (3PL) partner, or inventory management system (IMS). 5. Cost considerations of DTCDifferent DTC architectures change the cost of selling to customers. DTC companies need to consider how scaling globally impacts ownership costs and the staff capital needed to run DTC operations. As you grow your DTC, you’ll need to consider the following costs:

Direct-to-consumer best practicesScaling a global DTC is challenging. Learn how to scale effectively with these best practices. Customer experience best practicesTo remain competitive, DTC brands need to provide a top-quality experience throughout the full customer journey. As Eli Weiss the senior director of CX and retention at DTC Jones Road Beauty says, “Customer experience is not just the reactive resolving of problems, but rather looking holistically at the entire customer journey and ensuring expectations are being met.” Create an in-store experienceSince the start of the pandemic, consumer intent to purchase goods through online channels has increased by 40% to 60%. But, shoppers want it all. Nearly three in four (72%) consumers still rely on stores as part of their primary buying method. So DTC business owners need to meet customer preferences for both online and in-store physical shopping. For DTC brands with a younger target audience, unifying online and offline selling is even more important. Hybrid shopping (a blend of online and physical shopping) is the primary buying method for 27% of consumers and 36% of Gen Z—more than any other generation. For some DTC brands, this means growing beyond exclusively online sales and establishing a physical presence. DTC footwear brand Allbirds and eyewear provider Warby Parker have physical stores to encourage online customers to interact with their products in-person. Dental care DTC brand Quip partners with existing retail giants like Target to sell products. When Ricky Joshi of Saatva was asked about the brand’s omnichannel approach to customer experience, he described interactive in-person experiences that prioritize each individual customer’s shopping needs. “If you walk into any of our stores, which we're calling viewing rooms, they're more like the Tesla showroom model,” he says. “Every single bed has an electronic kiosk where you can do research on the product. The same way people are doing a lot of research on the web, we allow customers to walk into our viewing rooms and do their own research without needing someone to assist them if they don't want that.” Joshi explains these viewing rooms improve the shopping experience by letting customers deeply research products in person:

Prioritize customer supportConsumers expect omnichannel customer support. Fifty-eight percent of consumers say customer service on their preferred channel influences their decision to buy. Fifty-four percent of consumers purchased from a specific brand in the last year because they could easily reach customer service on the channel of their choice. And since 58% of consumers purchased from a specific brand due to excellent past customer service, DTC brands that invest more in their employees will win more customers. Apologize freelyWhen something goes wrong, DTC brands should show their human side by apologizing, even if it’s not their fault. Eli Weiss explains that there’s often a misconception about apologizing and that brands often prefer to shift blame rather than deal with the situation head-on. “You can apologize for the experience your customer is having with a DHL delay, even if it’s not necessarily your fault,” he says. “Apologizing for the negative experience your customer is having with any part of the customer journey is a net win.” Set realistic expectationsMeeting customer expectations is at the core of providing a top-tier customer experience. Think about the promises you make to customers and whether your company can realistically meet them. Consider everything from your in-store offering through to your shipping policies. Can your brand match customer expectations? Where is your company falling short? Weiss says that DTC brands need to think about the complete customer journey: “In order to ensure you’re meeting expectations at every part of the customer journey, it’s imperative to constantly look at the expectations your brand is setting and make sure you’re meeting them.” Weiss recommends under promising and over delivering to avoid missing the mark. “If you’re promising two-day delivery, is that being met with today’s supply chain constraints and broader carrier delays? You’d rather promise five-day delivery and get it to the customer in four days versus promising two days and it taking three,” he says Customer loyalty best practicesResearch shows that 65% of a company’s business comes from existing customers. Almost 60% of the typical DTC company’s revenue comes from customers who’ve bought previously. For DTC companies, brand loyalty is everything. Instead of acquiring new customers, doubling down on retention means profitable, long-term customer relationships. You’ll get loyal customers returning to you repeatedly—instead of back to marketplaces like Amazon once they’ve made their first sale. Build a communityOnline communities are niche groups of people with a shared interest. It’s not just subreddits powering the bulk of online communities, though. DTC brands are building their own communities to increase brand loyalty. Communities increase customer retention and brand awareness and decrease customer support costs. It’s no surprise then that 40% of global brands are creating new ways like community hubs for customers to interact with them. When asked about the power of community-building, Kimberly Smith, founder of DTC beauty and cosmetics brand Marjani and member of the National Retail Federation board of directors, says communities are replacing traditional marketing strategies, “Some brands have yet to even explore digital marketing or paid advertising because their community is so strong, she says. “They spend so much time [building] it that it drives the direct-to-consumer revenue.” DTC skin care brand Curology has a private members group on Facebook with over 15,000 members. The brand encourages members to share before and after results of using their products and skin care tips. Curology also shares UGC from the community on its Instagram account to its 452,000 followers: Create a loyalty programDirect-to-consumer brands manage to rack up an impressive retention rate of 25.9%. Part of that boils down to loyalty programs. When you consider that the average company loses 23% to 30% of its customer base each year due to a lack of customer loyalty, it’s essential to identify innovative ways to keep your customer base interested. Premium t-shirt DTC brand Goodlife has an incredible current retention rate of nearly 50%—defined as customers who place another order within four months of their first purchase. That’s higher than the apparel industry’s average retention rate of 26%, per McKinsey’s recent data. Goodlife just launched a try-before-you-buy program called “Try Now,” where the customer’s payment method isn’t charged until seven days after their purchase. “This is geared toward those hesitant in buying a $60 to $68 shirt,” says Andrew Codispoti, co-CEO of Goodlife. The brand also recently launched a subscription option, where customers can bundle four shirts for the price of three. Codispoti says these services were specifically designed to encourage retention and are being promoted to customers shortly after they place their first order. Haus, the first-ever DTC company in the liquor space, offers a monthly membership. Members get 10% off all orders, free shipping, access to members-only events, and two bottles of core flavors per month. Helena Price Hambrecht, co-founder of Haus, says those members-only events foster a sense of community and loyalty: “You can make that same kind of experience happen online,” she says.

Support causes that share your valuesTo catch the attention of savvy shoppers when selling directly to them, your brand needs to match their values. Consumers increasingly want companies to act as good people; those who ethically source their products, treat workers well, and have green manufacturing practices. The majority of shoppers are more likely to purchase from a company with shared values. Sixty-six percent of shoppers actively seek out eco-friendly brands, with 55% saying they would pay more for sustainable products. But these same shoppers are skeptical too—72% think that companies and brands overstate their sustainability efforts. It’s key to strike the right balance. Sarah Brown, the founder of Pai Skincare, agrees that brands need to align authentically with consumers’ values and avoid being generic. “Customers are looking for brands to align with their values. They are calling out complacency and demanding transparency. A purchase now represents your values, a demonstration of shared beliefs between customer and brand. “ Direct-to-consumer marketing best practicesStrengthening close customer relationships can help fuel DTC marketing campaigns. But take care to respect boundaries around customer privacy, otherwise you may jeopardize their trust. Source customer data ethically to build trustForty-six percent of DTC brands look to leverage transactional and behavioral data for personalization. But brands need to be conscious of customer preferences surrounding data use. A recent survey shows that 28% of consumers feel they have less control over their data than they did a year ago. Customers are increasingly concerned with how their data is used and handled by brands. To obtain valuable customer data, DTC brands need to respect customer boundaries. That could mean:

Connect with customers on social mediaThirty-six percent of consumers want social media content from DTC brands. Social media is also considered one of the top channels for DTC customer acquisition. But standing out on social media platforms is increasingly challenging. Essentials brand Bombas has over 200,000 Instagram followers. It showcases its playful branding with colorful product imagery. Invest in niche channels to reach your target audienceAs mainstream platforms like Instagram get crowded, DTC brands can reach target audiences on upcoming niche channels instead. Doe Lashes, a cruelty-free lash brand, shares content on Discord, a popular group chatting platform among gamers that attracts users of the same age bracket as Doe’s consumers. And on the apartment design game Design Home, players can purchase physical versions of products in their virtual apartments. Direct-to-consumer sales best practicesFollow these best practices to optimize DTC product sales. Diversify offeringTo keep shoppers interested in product offerings beyond an initial purchase, DTC brands need to expand beyond their initial hero offerings. Some examples include footwear brand Allbirds selling apparel and men’s razor company Harry’s launching a deodorant range. It’s also important to avoid overwhelming customers and setting customers up for “analysis paralysis.” Kate MacCabe, Vice President of product at Brooklinen, says that the bedding company has actually benefited from limiting consumers’ customizations, streamlining the path to purchase in the process. Plan sales in advanceDTC brands can take advantage of planning their own sales without retailers deciding how much of the initial price to cut. The key to successful sales is to create a sales strategy long before launch. That way, you can plan ways to boost reach and strengthen customer relationships. Chris Mikulin, founder of Kulin, a DTC performance marketing agency, suggests using sales as a way of building relationships with customers. “If the sale is really generous, or you have limited stock, or you just want to do something special for your email list—doing an early access sale with a slightly different discount from the public sale can do wonders for your brand. It can help make your customers feel more special, which can increase loyalty.” Mikulin also advises that DTCs shouldn’t be afraid of extending sales either. Some backup planning goes a long way in preventing last-minute panics.

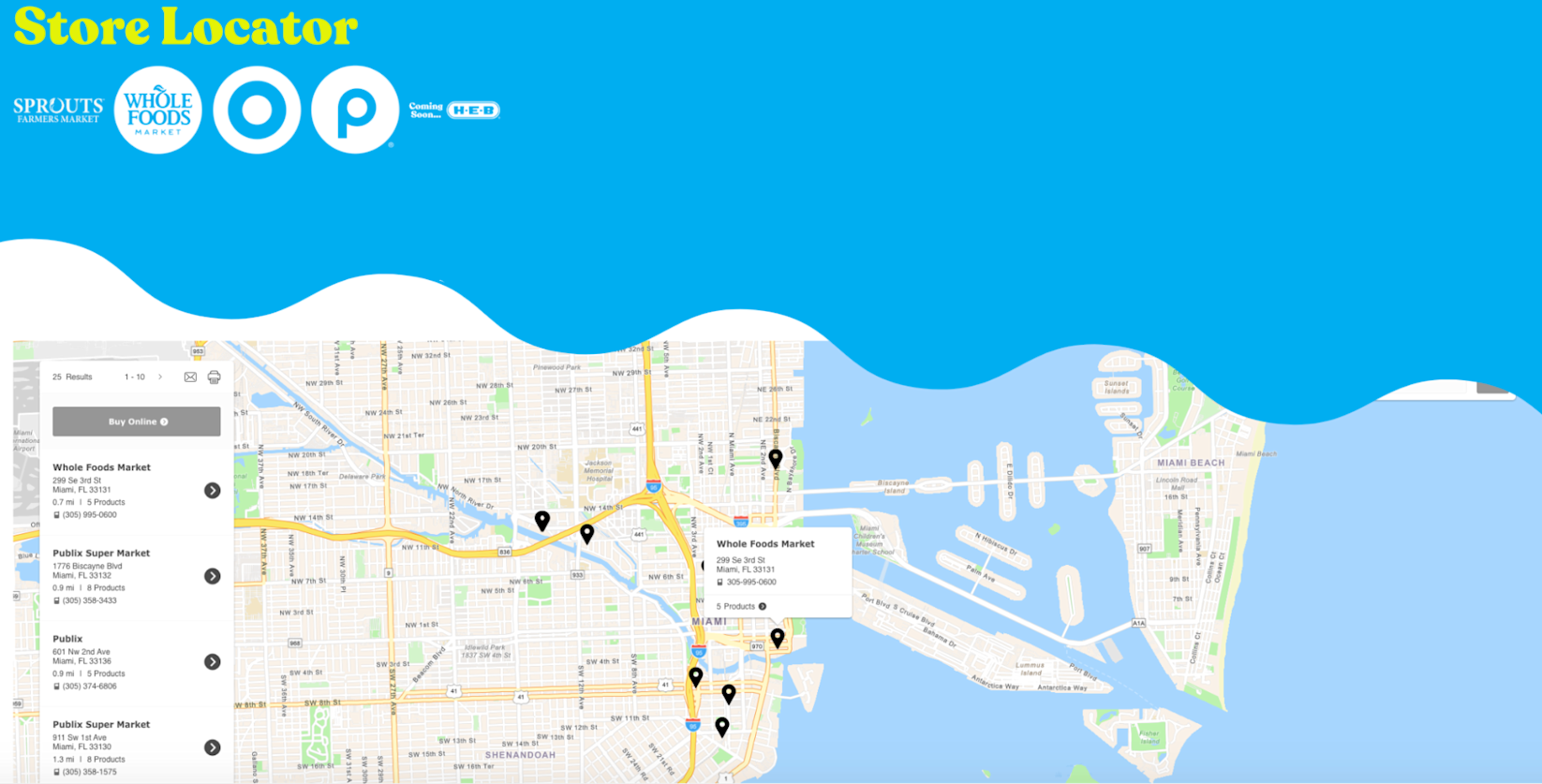

Get the latest ecommerce trends, insights and resources straight to your inboxBy submitting this form, you agree to receive promotional messages from Shopify. Unsubscribe any time by clicking the link in our emails. Best practices for the DTC and retail relationshipGoing DTC doesn’t mean you need to burn bridges with retail partners. Here’s how to maintain retail partnerships. Share customer insights with retailersDTC models make it easier to build relationships with customers. Give back to retailers by gathering customer data that will improve their sales and marketing strategies. Shane Pittson, vice president of growth at Quip, says that launching as a D2C allowed the oral hygiene provider better “data and perspectives” for conversations with retailers, setting the company up for success. Pop-upsChris Mikulin of Kulin says that having a retail presence accelerates the need for investing in brand building. How else are DTC brands going to stand out in crowded marketplaces? Shoppers are craving in-person experiences. Eighty-one percent of Gen Z consumers prefer to shop in-store to discover new products, and more than 50% say in-store browsing is a way to disconnect from the digital world. Pop-up shops can be a great way of getting in front of new customers and trialing physical stores. Leather jacket brand The Namesake regularly runs pop-up shops in New York City. The brand chooses upscale neighborhoods as “people who live there notice a new pop-up and can definitely afford our product, because our product is definitely at a luxury price point.” Mikulin adds that these in-person events can help your DTC brand connect with your target audience in places where they naturally spend time. “These are a great way to create experiences for your audience in a community that has strong demographic overlap with your audience. You can partner with local restaurants, events, and communities to display and sample your product.” Include store locators on your siteMake your retail partners a part of your DTC site by adding a store locator page. Instead of only using your site to drive DTC sales, show your customers that by visiting retail stores they can get exclusive discounts or purchase different product lines. Soda brand Poppi showcases the retail brands it partners with and includes a searchable store locator on its site. You don’t have to be DTC onlyThere’s no doubt that selling directly to the consumer has its advantages. You’re not paying a huge cut to big-box retailers, or sacrificing profit margins by selling to wholesalers. However, don’t feel like your choices are DTC or nothing. Legacy brands like Nike have demonstrated how to dip your toe into the DTC world without sacrificing retail partnerships. More brands are going DTC-first—not DTC-only. Test the waters by creating digitally native sectors of your brand. Own your customer experience—and convince them to purchase from your owned channels repeatedly. Direct to Consumer (DTC) FAQsWhat does direct-to-consumer mean?Direct-to-consumer (DTC) is when a brand sells directly to the consumer. Previous to DTC, brands would sell their products in larger retailers. If you are a shoe brand, chances are you would sell your brand in a shoe store. What is a DTC brand?A DTC brand is one that manages the entire supply chain process from manufacturing, to marketing and selling to the consumers. The DTC brand is able to control the whole buying experience. An example of a DTC brand is Allbirds. Is DTC growing?DTC, direct-to-consumer, has quickly expanded in most recent years due to the 2020 pandemic. According to eMarketer, direct-to-consumer sales has grown by 15.9% YoY. Why should brands direct to consumers?Direct to consumer is exactly what it is, selling directly to end customers. The strategy behind this approach is that it bypasses wholesalers and retailers, thus cutting out unnecessary costs associated with having intermediaries between manufacturers and the consumer.

Why does DTC strategy boost profitability?Since DTC models require fewer resources and therefore have lower costs, you can sell your products at lower prices than retailers while still maintaining higher profit margins than most B2C companies.

How does DTC strategy satisfy customers?By taking advantage of DTC marketing, a brand controls the consumer's complete path, from awareness to purchase and further to loyalty. When the middleman is absent, the consumer's journey down the sales funnel is often faster.

Why is DTC so important?Because DTC allows each brand direct access to consumers through any number of channels, the brand can build a better relationship with their customers by connecting with them directly and offering the type of content that resonates best with their audiences. Improving the customer experience.

|